We had an expanding product portfolio, emerging non-English markets and a growing demand for simultaneous product shipment (software and documentation) in multiple languages. We needed to look at how best to manage our translation effort to meet corporate expectations. We were challenged to look at all possibilities that would meet delivery expectations without impacting quality and cost.

Prior to embarking on any initiative to address this challenge, it was imperative to answer these primary questions.

Ÿ How effective is our current vendor strategy against future growth plans?

Ÿ What are our delivery expectations from our suppliers?

Ÿ What is the overall, long-term value proposition from our suppliers?

Ÿ Is there a need to re-assess the current goals and objectives of our translation resource strategy?

Ÿ Could a resource model be developed to assess the different approaches to managing the localization effort, a model that also would serve as a supplier management scorecard to gauge supplier performance? What is the value within Cognos for each of these models in terms of meeting quality and time-to-market expectations? What are the opportunities and risks?

Ÿ What is the most effective and optimal model for delivering on supplier management?

To find answers and solutions to these challenges, we began by developing a resource model, one that allowed us to assess the results of various industry resource models. Through this assessment, we needed to arrive at objective conclusions on a supplier management strategy, based on the benefits and risk assessments of each model. The process also provided the opportunity to re-assess translation costs against different resource models—not just once, but on a continuous basis.

The main objectives of the resource model were to determine the most effective means for providing content translation within Cognos and to ensure our localization supplier strategy best fit our long-term localization requirements. This also was an attempt to create a supplier management scorecard that measures the performance and the health of the supplier relationship.

The primary resource models applicable to the localization industry are in-house translation, multiple-language vendors (MLVs), single language vendors (SLVs), and freelancers. This could include a hybrid model, a combination of in-house and outsourced translation or a completely outsourced solution that is a combination of MLVs and SLVs. The resource model could also vary depending on the resource type (translators, linguistic reviewers, and engineers), where the work is being procured, and where the resources reside.

During the initial assessment, Cognos needed to determine the appropriate tool for resource modeling. We needed a tool that provided a significant level of flexibility in assessing the impact of change in any one of the variables (resource type, per word unit rate, scope, throughput, etc.). This tool assessment included a variety of tools, from off-the-shelf products to more complex products, including enterprise business-intelligence tools and corporate performance-management tools.

The structure of the model provided multiple data-entry points and a simple means to modify the data, which enabled us to understand the impact of changes.

Our Localization Resource Model, as we referred to it, provided an analysis of the various approaches to resource strategies, comparing them to each other and a baseline model (the status quo). The structure of the model answered critical questions pertaining to the localization effort:

Ÿ What: Defined project dynamics driven by scope

Ÿ Who: Defined who will do what, according to resource type.

Ÿ Now: Defined the current resource model.

Ÿ How many: Defined the number of resources (headcount) required to expedite the project against minimum delivery expectations.

Ÿ How much: Defined core throughput metrics and associated cost, which then drove all calculations and determined all costs.

Ÿ What cost: Provided summary of cost by language for each model type and determined the project duration based on resource allocation.

Ÿ Variance: Defined the potential cost and variance by model type against the baseline model.

Once the Cognos Localization Resource Model was established, it provided an easy and flexible means to assess potential costs, both internal and external, and to assess resource requirements by language—for each different model type. And this degree of assessment could be based on a single project or on a number of projects, across any given duration.

The model also provided an opportunity to assess which variable triggered the final outcome for each model type. This is an important factor to consider prior to reaching a conclusion in the modeling exercise, as an insignificant variation in any one of the variables might alter the end result. Such knowledge can affect your ultimate actions. For example, rather than making a significant shift in suppliers, you might simply renegotiate costs with your current supplier(s).

With any change in supplier strategy, risk management must be applied. Risk management functions need to be clearly defined, in order to achieve an accurate analysis. The benefits of each model type must be weighed against the degree of risk and whether it can be mitigated. To identify the risk for each model, the following questions were asked:

Ÿ What causes the risk to happen?

Ÿ What is its likelihood/probability?

Ÿ What is its impact, financially, operationally, and performance-specific?

Ÿ What is the type of risk and the degree of impact on the risk elements?

Ÿ Can the risk be mitigated?

These following risk elements were identified:

Ÿ Quality and operational effectiveness (translation quality, product and process knowledge, etc.)

Ÿ Adherence to schedules

Ÿ Accountability and ownership

Ÿ Loss of intellectual capital (loss of competitive advantage and overdependence on outside firms for critical functions, because of reduced control, also referred to as ‘hollowing’)

Ÿ Staffing (potential for finding qualified resources, resource fluctuations, etc.)

Ÿ Longevity, strategic flexibility, and reversibility of the model

Ÿ Impact to other organizations (in-country offices, human resources, management, etc.)

For some organizations, in order to lower localization costs without increasing risk, it may be advantageous to migrate toward an external resource model, depending on the stability and maturity of the product. With a mature product, it’s more probable that established processes and standards are in place. Software terminology and glossaries, for example, are established and less volatile. In this scenario, the potential advantages are time-to market, more efficient use of internal resources, and lower localization costs, plus the ability to mitigate all risks.

In resource modeling, the results can differ significantly among organizations, depending on operational size and structure and on localization requirements and their associated costs. At Cognos, once all the data was collected and input into the Localization Resource Model, and the results were assessed, the most effective and appropriate model was clear. (See Figure 1 on previous page.)

The resource model was only part of the solution to meet the growth and efficiency challenges Cognos faced. Once we aligned on the most suitable resource model, we then proceeded to define the supplier selection process and metrics initiative.

The key objective of supplier selection was to drive and communicate our service requirements as part of a large-scale, phased RFP process. The process allowed for cost proposals and for full evaluation of the service quality of responding vendors.

Achieving this objective required an emphasis on partnership. Our analysis clearly justified the need to establish long-term partnerships with suppliers, given the complexity of our products, our proprietary localization tools and processes, and the initial expense required for knowledge transfer.

We also placed emphasis on the transparency and flexibility of suppliers. We looked for proven ability to collaborate on ancillary projects, in order to drive optimization and operational efficiency, particularly on revenue-based localization projects. We determined the following best practices for driving a strong and long-term relationship with suppliers:

Ÿ Define your processes and drive them with your supplier.

Ÿ Assess flexibility of the supplier to adapt to client preferred processes, tools, etc.

Ÿ Create a transparent operational model that enables close integration with clients.

Ÿ Gauge performance through a shared metrics program.

Ÿ Emphasize partnership—jointly set vision, goals, commitments, and long-term collaborative investments.

Ÿ Build a cost-effective, client-based program that delivers everything the client needs.

Ÿ Ensure your supplier strategy matches your needs (translation requirements, tools, structure, vision, etc).

Cognos is a strong proponent of gathering metrics on projects and measuring performance. We monitor how both Cognos and our suppliers are performing. Project reviews help establish clear best practices and define expectations on future projects, which strengthen the partnership. We view standardization of practices and continuous process improvement as mandatory requirements.

Since the inception and application of the new resource model, we have deployed our phased RFP process and have piloted the new strategy on a significant release; the outstanding success we achieved validated the strategy. Localization cost savings are forecast to exceed 25% and will be sustainable with projected growth.

Additionally, a process for continuous post project review has been established. This will ensure that we regularly assess the impact of changes to any of the parameters in the resource model, the impact of new technologies (which may influence process, throughput, resources, and costs), and the impact of changes in supplier offerings.

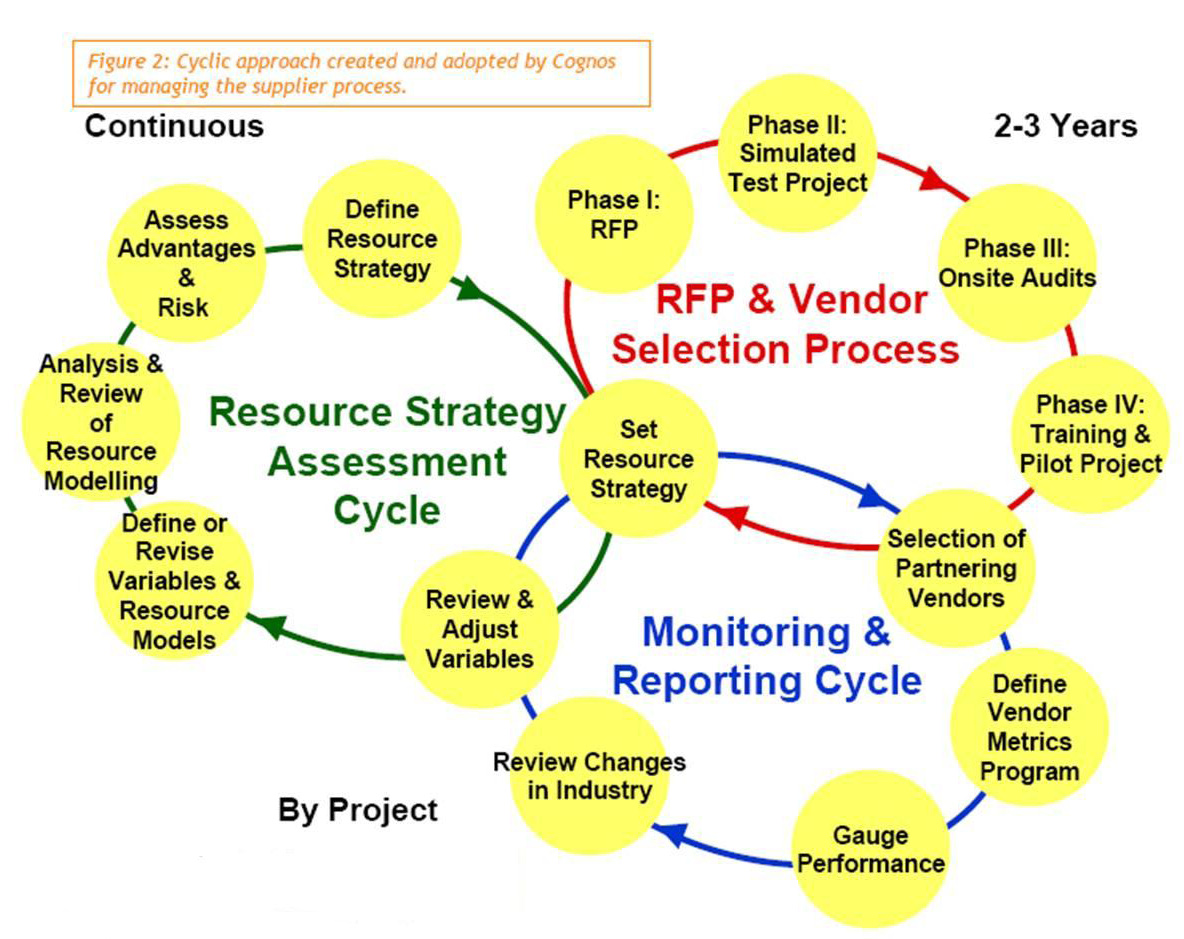

Figure 2 on the previous page illustrates the cyclic approach created and adopted by Cognos for managing the supplier process. It is a holistic and sustainable approach.